Lake County Auditor Chris Galloway starts speaking to the Commissioners at the two meeting mark in the video below. He is discussing the 2024 sexennial property tax valuation that will increase the tax collections in 2025.

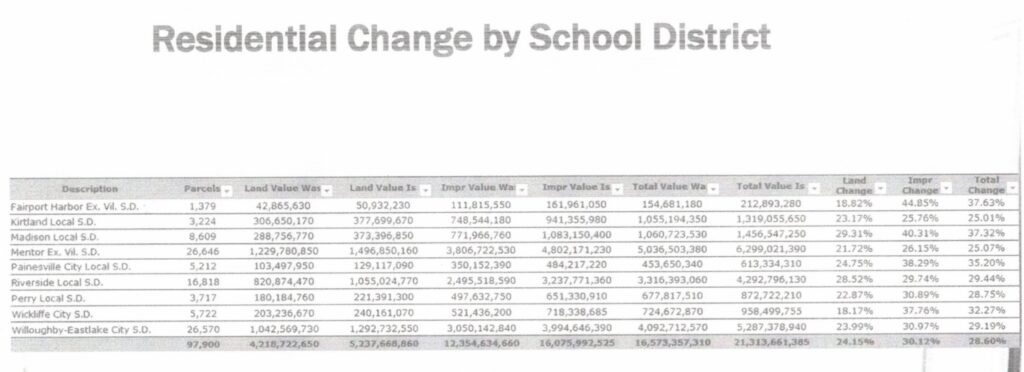

It should be noted that an increase of 30% does not necessarily mean a 30% increase in your property taxes. A great deal depends on the school district in which you live. If you live in a school that is at the 20 mill floor (Willoughby-Eastlake, Kirtland, and Perry), you will pay an additional $210 per $100K of home market value. A 30% increase will mean that the Riverside school district will reach the 20 mill floor. They anticipate that a taxpayer in their district will pay $93 per $100K of home market value.

Here is Auditor Galloway’s complete report he gave to the Commissioners:

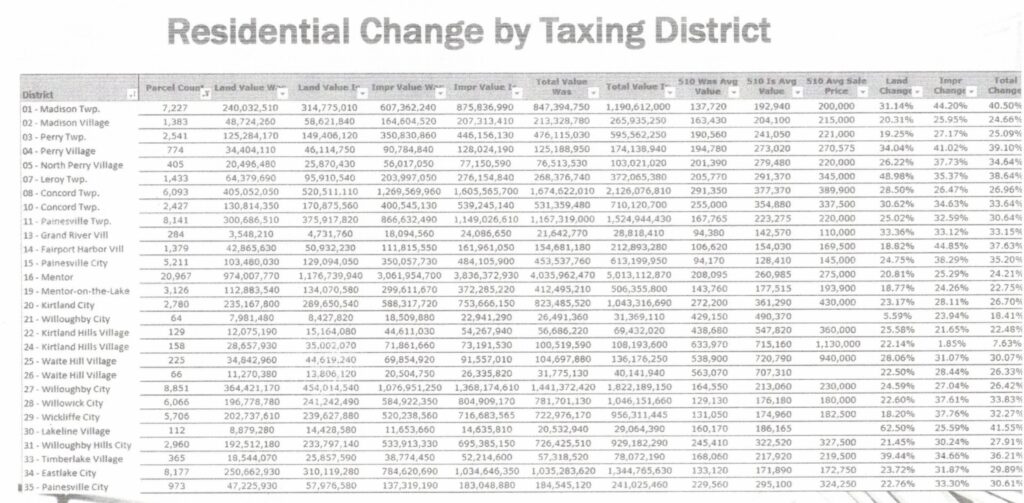

We sorted the increase in property values for each taxing district from highest to lowest increase. The overall increase was 29.90%.

Who is looking out for the financial interest of the average Lake County citizen?

ANWSER: NO ONE!

ANY TAX THAT CAUSES A CITIZEN TO BECOME HOMELESS IS IMMORAL!

Categories: Lake County Cities & Townships