By Brian Massie, A Watchman on the Wall

The mandatory market reappraisal of all Lake County properties will take place in 2024 with the tax to be collected in 2025.

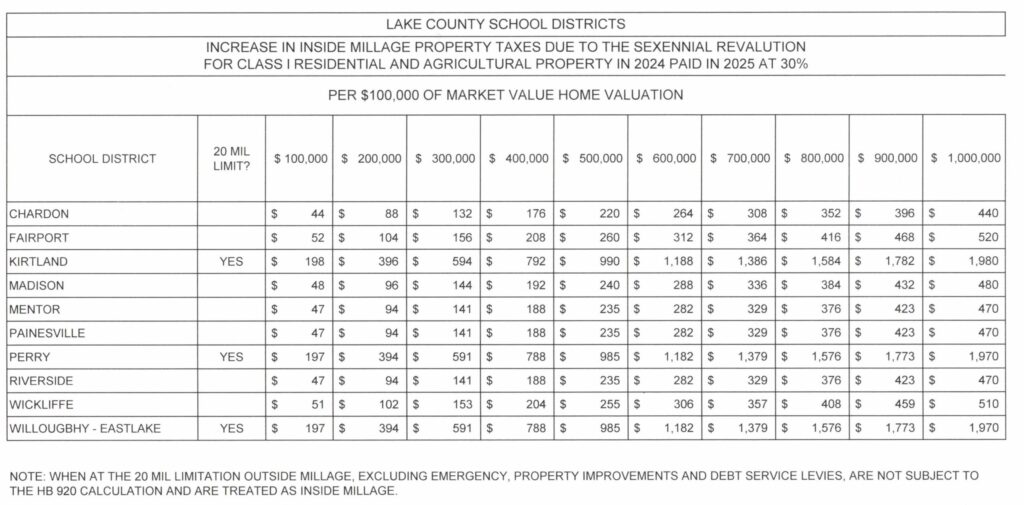

Here is a list of the estimated projected annual tax increases for the school districts per $100,000 of home market value:

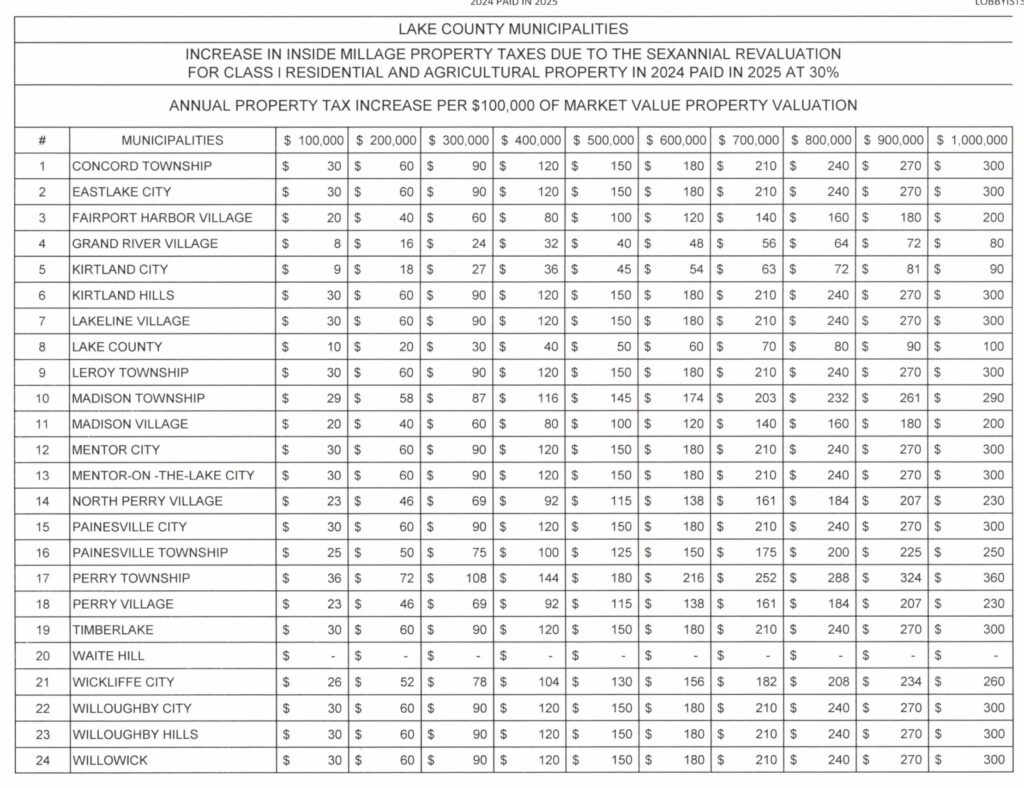

Here is a schedule of the estimated projected annual tax for the municipalities increase per $100,000 of home market value.

As an example, a home with a market value of $500,000 in Kirtland could see the following annual property tax increase:

Lake County $50

Kirtland City $45

Kirtland School District $990

Total $1,085

*****

Categories: Uncategorized