LFC Comments: We have complained to Lorraine Fende, Lake County Treasurer, about the form she sends out with the property tax bills. The original is in light blue ink making it difficult for most seniors to read, and it is confusing since it does not provide adequate details of total inside millage versus outside millage. Ms. Fende’s lack of interest was very disappointing. As a reminder, Ms. Fende will be on the November ballot running against Mike Zuren of Eastlake. It is important that we have a Treasurer that is responsive to the needs of the taxpayers.

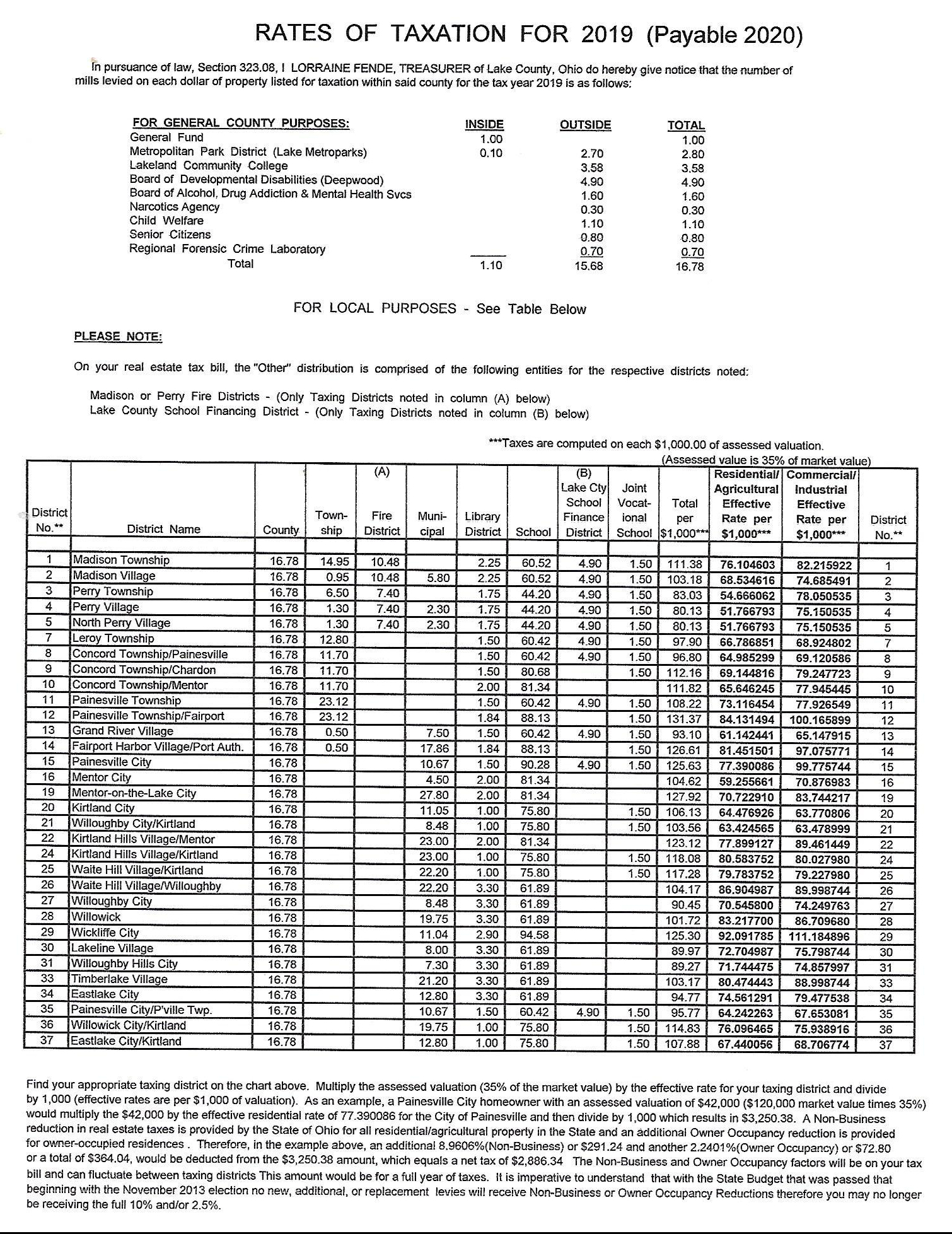

Remember, the inside millage is mandated by State law [10 mills], and the taxpayers do not get to vote on it. Here is the form sent out by the Treasurer’s office to just meet the Ohio Revised Code.

Our guess is that very few taxpayers even understand this report, and we know that no one can understand the difference between the inside millage and outside millage from what is being shown.

We contacted the ever helpful Lake County Auditor’s office and got the back up schedules that provide the details needed to answer our questions. For your review, we are showing the schedules for the Concord Township Taxing Districts 8, 9, 10. If there is any interest in seeing the other districts, please add any request to the comment section, and we will update this article as needed.

Concord / Riverside L.S.D. – Concord Riverside Taxing District 8 (2)

Concord / Chardon L.S.D. – Concord Chardon Taxing District 9

Concord / Mentor E.V. S. D. – Concord Mentor Taxing District 10

E.V.S.D. = Exempted Village School District

The school districts, library districts, and support for Auburn Joint Vocational school, are different.

District 8 and 10 have 8.9 inside millage, and district 9 has 8.60 inside millage. The inside millage is controlled by the Lake County Commissioners, and they guard it like a “hungry dog on a bone”. A political sub-division can request a tax increase under the inside millage without the vote of the taxpayer, but it would have to be approved by the Commissioners.

One further point of clarification – The total gross tax rate is the total number of outside millage as originally passed by the taxpayers. The effective tax rate is the millage adjusted because of House Bill 920 that was passed to offset the inflationary increases in home values.

“In 1976, the Ohio General Assembly passed House Bill (HB) 920, which reduces the taxes charged by a voted levy to offset increases in the value of real property. This is called the property tax reduction factor or HB 920 factor. The reduction factor applies to both Class I and Class II real property.”

Class 1 property includes residential and agricultural property.

Class 2 property includes commercial and industrial property.

We hope this helps our readers better understand the complexities of their property taxes.

*****

Categories: Uncategorized

Leave a Reply

You must be logged in to post a comment.