(LFC Comments: We wanted to share with our readers the correspondence between LFC and the Lake County Riverside School District. We would like to thank Mr. Gary Platko, Chief Financial Officer and Ms. Belinda Grassi, School Board Member, for their prompt, honest and transparent responses to our questions. This is part 1 of 2 dealing with Riverside School District.)

*********************1776

Our email to Mr. Platko with a copy to Ms. Grassi:

Brian Massie

a 501 (c) (4) Non-Profit

*********************1776

Hi Brian,

Here are the answers to your questions on the five year forecast.

Line 1.060 All Other Operating Revenue is made up of various line items including revenue from the Lake County School Financing District, open enrollment, pay to participate fees, classroom fees, interest, revenue from TIF agreements, Medicaid revenue, excess cost revenue, field trips, shared services, manufactured homes tax revenue, rentals, fines, donations, and other revenues.

If the levy is renewed on March 17, 2020, collection will begin in calendar year 2021 and the district will not experience any loss in revenue. The May 2020 forecast update will reflect the results from the March 17, 2020 election. I believe this answers your first two questions regarding the projected reduction and the impact of the renewal on the March ballot. Let me know if you need any additional clarification.

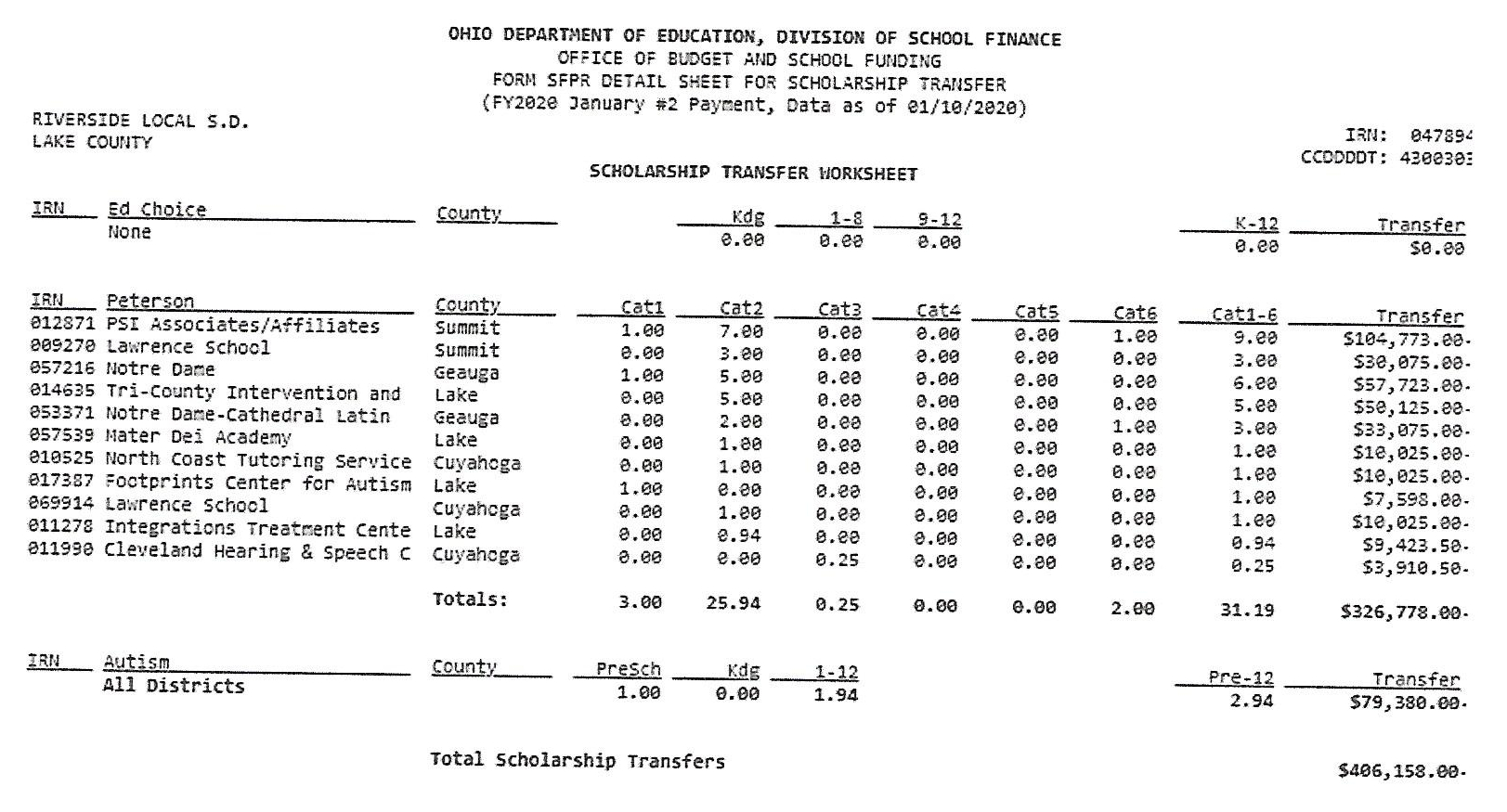

For the current fiscal year, we are not an EdChoice school so there is no cost to Riverside currently. As you know, we are on the list for next year and there is currently a debate in the legislature on making changes.

At this time, we are not certain how that will progress. The current forecast does not include any cost for EdChoice but will be updated in May once we know more. The cost of EdChoice could be significant.

Also, thank you to Belinda for the background on the previous consideration of an income tax levy. I know it was looked at in the past, but I did not have any background on the details.

If you have any additional questions, please let me know.

Thank you,

Gary A. Platko, CPA

*********************1776

Belinda Grassi

Here is the thoughtful response from Ms. Belinda Grassi, Riverside School Board Vice-President:

Hi Brian – I’m going to let Gary answer your questions, but I thought I’d just add a few of my own personal thoughts on your questions for your consideration.

To be clear, and I’m sure you know, but schools are not the only beneficiaries of property taxes, and cannot be considered the sole culprit of “pricing seniors out of their homes”. Lakeland, Metroparks, County government, Township expenses (because townships cannot legally assess income taxes so property taxes are higher – which pay for fire, police, etc that are normally paid for by city income taxes), Libraries, County Crime Lab, Seniors, Dept. of Developmental Disability, and others are funded by property taxes also. I won’t expound on the validity of some of the tax requests we’ve seen lately for some of these agencies – you can be the judge of that.

Social Security increases do not keep up with inflation to be sure – I think my husband saw his benefits increase by less than $100 a month this year, of which an additional $30 was taken back for increased Medicare cost. I get it. However, the 4.32% you see in the wages & benefits line of our 5 year forecast is attributable to rising health care costs as well as salaries – and the rise in benefit costs is growing at a much higher percentage year to year than wages are. Gary can likely provide you with those individual breakdowns. We all know how the cost of health benefits keeps rising. And to be clear on that end, The State of Ohio Public Employee Retirement System for example just passed on a very large increase to the beneficiaries of their pension system. So it’s not just Riverside experiencing increasing health care costs. The entire county sees this as a very large issue of concern as I’m sure you are well aware.

As for an income tax, the topic was considered at length prior to Gary’s arrival at Riverside, maybe even before Tom’s election. Back in the 2010-2012 period when we had to make drastic cuts to our budgets due to compounded circumstances – inefficiencies that have since been addressed (we’ve gotten so much smarter since then!), falling property values etc. Considering that the largest block of “anti-tax” voters is also located in the community with the highest district wages, it was determined that an income tax levy would fail even more miserably than a property tax levy that would be proposed.

While I realize that an income tax shields seniors from rising property taxes, I also realize that wage earners vote and even an income tax of 1% levied on their earnings will cost them more than a property tax would – and would likely fail at even higher rates among those voter populations. Considering that “taxes” in general are now a limited federal income tax deduction doesn’t help in either case.

I’d be willing to consider an income tax, but school income tax levies in general have largely been reserved throughout the state to compensate districts in areas where property value is low and agricultural property use is high. Those districts don’t generate a wealth of property tax, and the law to allow school district income taxes was passed based on the assumption that those districts needed a way to generate funding when the only source of tax generation at the time was on property values. That doesn’t mean we can’t consider one. It just means that it would be exponentially harder to pass. It also means that even low-wage earners who have no property wealth would also be taxed on their earnings.

In my view, it shifts the tax burden from the seniors to the low income earners, and that’s probably even less fair than our current structure. And in many cases, the seniors have a better ability to pay than those current low-wage earners for many reasons too numerous to expound on here.

Anyway, that’s just my 2 cents added to whatever numerical and statistical data Gary can provide to you.

*********************1776

Commissioner Dan Troy was “front and center” on that issue, but he did get the inside millage on the property tax reduced. It did not completely offset the income generated by the sales tax, but at least Troy was cognizant of the plight of seniors with property taxes.

Regarding lower income earners, they do get the federal earned income credit the reduces and may eliminate their federal income taxes. https://www.irs.gov/pub/irs-pdf/p5334.pdf )

Categories: Concord

Leave a Reply

You must be logged in to post a comment.